The blog is with intention to enhance and polish your wealth management skills. Let's learn up the skill set to pick up the bull running hot stock for the day... We will discuss it based on TA (Technical Analysis). We will learn to establish a good TP (trading plan) and be disciplined in trading. Most importantly, we could learn from the friend all around the world. This blog is definitely able to provide a platform to TA devourer for in-depth discussion.

Thursday 28 July 2011

Case Study - CHHB

1. Trendline: Sideway (Neutral)

2. Bollinger Band: Start to squeeze, pending breakout (Neutral)

3. Candle Stick: White Body (Bullish)

4. ADX: Uptrend with strong momentum (Bullish)

5. MACD: fluctuating above 0 (Neutral)

6. RSI: Rebounce from 30%, pending break 50% (Bullish)

7. Stochastic: Break 50% (Bullish)

8. Volume Distribution: High buying pressure (Bullish)

Conclusion: 5 Bull 3 Neutral

Entry Price: 1.21

profit Taking: 1.24,1.28, 1.34,1.41

Cut Loss: 1.14

Case Study - Support

1. Trendline: Sideway (Neutral)

2. Bollinger Band: Both upper and lower is squeezing (Neutral)

3. ADX: Bullish crossover with weak momentum (Bullish)

4. MACD: Bullish crossover (Bullish)

5. RSI: Re-bounce from 50% (Bullish)

6. Stochastic: Drop to 80% (Bullish)

7. Volume Distribution: High buying pressure (Bullish)

Conclusion: 5 Bull 2 Neutral

Entry Price: 1.04

Profit Taking: 1.07, 1.13

Cut Loss: 1.01

Remarks: Take note on last minutes big sharks selling force...

Case Study - Bertam

1. Trendline: Sideway (Neutral)

2. Bollinger Band : BB breakout with volume after 2 weeks squeezed, both upper and lower band are widening which increase the volatility of price (Bullish)

3. Candle stick: white long body (Bullish)

4. ADX: uptrend with weak momentum (Bullish)

5. MACD: Forming bottom round and approaching 0 (Bullish)

6. RSI : Touch 70% (Bullish)

7. Stochastic: Rebounce and above 80% (Bullish)

8. Volume Distribution: High buying pressure (Bullish)

Conclusion: 7 Bull 1 Neutral

Entry Price: 0.785

Profit Taking: 0.82, 0.87, 0.91

Cut Loss: 0.74

Remarks: Beware of false breakout as high selling pressure by Sharks close to market end.

Case Study - Olympia

1. Trendline : Sideway (Neutral)

2. Bollinger Band: Breakout with high volume (Bullish)

3. Candle Stick : Long white body (Bullish)

4. ADX: Uptrend with weak momentum (Bullish)

5. MACD : forming bottom round and crossing 0 (Bullish)

6. RSI : Rebounce from 30% (Bullish)

7. Stochastic: Break 80% (Bullish)

8. Volume Distribution: High buying pressure when close to market end (Bullish)

Conclusion: 7 Bull 1 Neutral

Entry Price: 0.325

Profit Taking: 0.36, 0.41, 0.465

Cut Loss: 0.29

Case Study - MBSB

1. Trenline : Sideway (Neutral)

2. Candle Stick: Long white candle (Bullish)

3. Bollinger Band: Both upper and lower band is widening, thus increase the volativility of price (Bullish)

4. Support: Above 20, 50 EMA (Bullish)

5. ADX: Uptrend with weak momentum (Bullish)

6. MACD: Forming bottom round and break 0 (Bullish)

7. RSI : Rebounce and break above 50% (Bullish)

8. Stochastic: Break 80% (Bullish)

9. Volume Distribution: High buying force (Bullish)

Conclusion: 8 Bull 1 Neutral

Entry Price : 1.48

Profit Taking: 1.57, 1.63, 1.71

Cut Loss: 1.44

Case Study - DXN (Second Wave)?

Rienne, per your request.

1. Trendline: Uptrend (Bullish)

2. Double bottom (circled with pink) with hammer form on support (1.34), potential bullish reversal pattern -- Bullish

3. Support : Above 20, 30 & 200 EMA (Bullish)

4. Bollinger Band : Lower and upper band trending up, indication for uptrend for shorterm (Bullish)

5.ADX: Uptrend with strong momentu (Bullish)

6. MACD: Above 0 (Bullish)

7. RSI : fluctuating below 70%, pending break above 70% (Neutral)

8. Stochastic: fluctuating between 50% & 80%, pending break above 80% (Neutral)

9. Volume Distribution:

Conclusion: 7 Bull 2 Neutral

Entry Price: 1.42

Profit Taking: 1.47, 1.50, 1.53

Cut Loss: 1.38

Remarks: Beware of head & shoulder pattern if break below 1.34. Also, please wait for confirmation of candlestick on next day before position your trading. Good luck!

Case Study - Farlim

1. Long term Trenline: Downtrend (Bearish)

2. Forming higher low (Bullish)

3. Bollinger Band : Upper band expanding upper while lower band flat, uptrend in shorterm (Bullish)

4. Support : Above 20, 50 EMA, below 200 EMA -- conincident become resistance on 25'May & 26'July (Neutral)

5. ADX : Uptrend with strong momentum (Bullish)

6. MACD : singal line trending up above 0 (Bullish)

7. RSI: Above 50%, pending breaking 70% (Neutral)

8. Stochastic: Bearish crossover (Bearish)

9. Volume Distribution:

Conclusion: 5 Bull 2 Bear 2 Neutral

Entry Price: 0.33

Profit Taking: 0.345, 0.37,

Cut Loss: 0.315

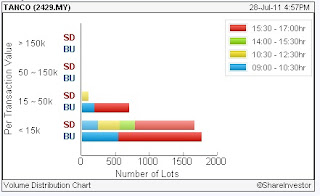

Case Study - Tanco

1. Trendline: Downtrend (Bearish)

2. Bollinger band : Squeezing and potentially breakout anytime (Neutral)

3. Support : Below 20, 50, 200 EMA (Bearish)

4. Forming higher low (Bullish)

5. Candle Stick : Long white body (Bullish)

6. ADX : Uptrend with bullish crossver, weak momentum (Bullish)

7. MACD : Neutral

8. RSI: Rebounce and touching 50% (Bullish)

9. Stochastic: Bullish kissing with signal line above 80% (Bullish)

10. Volume Distribution: Strong buying force (Bullish)

Conclusion : 6 Bull 2 Bear 2 Neutral

Entry Price : 0.255

Profit Taking : 0.27, 0.30, 0.33

Cut Loss : 0.230

Case Study - KUB

1. Trendline : Consolidatoin in symmetrical triangle which pending breakout, Sideway (Neutral)

2. Bollinger band: Lower band start to move upward, indication of short term uptrend (Bullish)

3. ADX: Uptrend with weak momentum (Bullish)

4. MACD: Neutral

5. RSI : Rebounce towards 50% (Bullish)

6. Stochastic: Bullish crossover with signal above 80% (Bullish)

7. Volume Distribution: Buying pressure is high close to market end (Bullish)

Conclusion: 5 Bull 2 Neutral

Entry Price: 0.77

Profit Taking: 0.78, 0.81, 0.84

Cut Loss 0.75

Remarks: Only buy when symmetrical triangle breakout with volume support. Also, the breakout should would expand BB and make the price volatile.

Wednesday 27 July 2011

Case Study - E&O

1. Trendline : Sideway (Neutral)

2. Candle Stick : Long white body (Bullish)

3. Support : Below 20, 50 EMA (Bearish)

4. Bollinger Band : Upper & Lower Band is narrowing, pending breakout (Neutral)

5. ADX: Uptrend with moderate momentum (Bullish)

6. MACD : Bullish kissing, pending breakout by confirmation (Neutral)

7. RSI : Rebounce from 30%, heading 50% (Bullish)

8. Stochastic : Break 50% (Bullish)

9. Volume Distribution : High buying force (Bullish)

Conclusion: 5 Bull 1 Bear 3 Neutral

Entry Price: 1.54

Profit Taking: 1.58, 1.63

Cut Loss 1.50

Remarks: Apply sideway (channel trading) at this momment until it break 1.65 and forming higher low / higher high to ensure the trend has changed to uptrend

Case Study - SOP

1. Trendline: Uptrend (Bullish)

2. Candle stick : White long body (Bullish)

3. Support : Above 20, 50, 200 EMA (Bullish)

4. Bollinger band, Both upper & lower band narrowing, pending breakout (Neutral)

5. ADX : uptrend with moderate momentum (Bullish)

6. MACD : 4R1G (Bullish)

7. RSI : Rebounce and break 50% (Bullish)

8. Stochastic : Bullish crossover and touching 80% (Bullish)

9. Volume Distribution : High selling pressure from SHARKs to retailer close to end of market (Bearish)

Conclusion: 7 Bull 1 Bear 1 Neutral

Entry Price : 4.23

Profit Taking: 4.29, 4,36, 4.42, 4.48

Cut Loss : 4.19

Remarks: Beware of the selling pressure big sharks. Advice to monitor closely on the volume distribution, if selling force from sharks continue to be high. Sell immediately!

Case Study - Bornoil

1. Trendline : Downtrend (Bearish)

2. Candle Stick : Long white body (Bullish)

3. Bollinger band : Upper & lower band narrowing, pending breakout (Neutral)

4. Support: Above 20, 30 & 200 EMA (Bullish)

5. ADX : Bullish crossover, uptrend with weak momentum (Bullish)

6. MACD : Bullish crossover and breaking 0 (Bullish)

7. RSI: Rebounce from 50% (Bullish)

8. Stochastic: Break 80% (Bullish)

9. Volume Distribution: High buying force (Bullish)

Conclusion: 7 Bull 1 Bear 1 Neutral

Entry Price: 0.460

Profit Taking: 0.50, 0.54, 0.57, 0.62

Cut Loss : 0.44

Case Study - Dialog

1. Trendline : Downtrend since 6/2 (Bearish)

2. Break L1 (pink line) resistance with high volume which greated than 30d MA, downtrend stopped, potentiall turn to sideway / uptrend (Bullish)

3. Bollinger Band : Upper & Lower Band is narrowing, sideway (Neutral)

4. Candle stick : Spining top (Neutral)

5. forming higher low (Bullish)

6. ADX : uptrend with moderate momentum (Bullish)

7. MACD : Bullish crossover and pending to form bottom round and cross up 0(Bullish)

8. RSI : touch 50% (Bullish)

9. Stochastic : Break up 80% (Bullish)

10. Volume Distribution : Strong buying force (Bullish)

Conclusion: 7 Bull 1 Bear 2 Neutral

Entry Price: 2.68

Profit Taking : 2.79, 2.86, 2.92

Cut Loss : 2.64

Case Study - Hiro

1. Trendline : Sideway (Neutral)

2. Candle Stick : White body (Bullish)

3. Bollinger Band : Both upper & lower band opening start to widen, price might more volatility (Bullish)

4. ADX : Bullish crossover, uptrend with moderate momentum (Bullish)

5. MACD : Bullish crossover (Bullish)

6. RSI : Breakout 50%, pending break up 70% (Bullish)

7. Stochastic : Break up 80% (Bullish)

8. Volume Distribution : High buying force especially close to market end. (Bullish)

Conclusion : 7 Bull 1 Neautral

Entry Price : 0.81

Profit Taking : 0.825, 0.84, 0.86(TP1), 0.88, 0.90 (TP2)

Cut Loss: 0.79

Case Study - Media

1. Trendline : Consolidation for 2.5 months (Neautral)

2. Bollinger Band : Upper band start to opern which would increase volatility (Bullish)

3. Candle Stick: White Body (Bullish)

4. ADX : Uptrend with moderate momentum (Bullish)

5. MACD : Bullish kissing above 0 (Bullish)

6. RSI : Rebounce from 50%, pending break up 70% (Bullish)

7. Stochastic : Rebounce and break 80% (Bullish)

8. Volume Distribution :Big selling force from big shark at end of market. Overall, both selling and buying force are comparable today. (Neutral)

Conclusion : 6 Bull 2 Neautral

Entry Price : 2.92

Profit Taking : 2. 96, 3.05, 3.15, 3.24, 3.32

Cut Loss : 2.81

Remarks: Please pay extra careful when trade with this counter to prevent in trapping in the sideway.

Case Study - Gadang

1. Trendliline Analysis: Consolidation for 1.5 month after long downtrend (Neautral)

2. Bollinger Band : Both upper & lower band opening widen, thus increase price volatility (Bullish)

3. Candle Stick : Long white body (Bullish)

4. ADX : Uptrend with weak momentum (Bullish)

5. MACD : Bullish crossover above 0 (Bullish)

6. RSI : Above 50%, pending break up 70% (Bullish)

7. Stochastic: Rebounce and touch 80% (Bullish)

8. Volume Distribution : High selling pressure by Sharks to retailer, beware (Bearish)

Conclusion: 6 Bull 1 Bear 1 Neautral

Entry Price: 0.715

Profit Taking: 0.735, 0.76, 0.79

Cut Loss: 0.685

Case Study - Hexagon

1. Trendline : Consolidation for 2 months after 'waterfall' downtrend (Neatural)

2. Break symmetrical triangle during consolidation with TP achieved (Bullish)

3. Form higher high & higher low (Bullish)

4. Bollinger Band : Both upper & lower band opening is widen (Bullish)

5. ADX: uptrend with moderate momentum (Bullish)

6. MACD : Forming a round bottom and crossing up 0 (Bullish)

7. RSI : Rebounce up from 70% (Bullish)

8. Stochastic : Rebounce and break 80% with bullish cross over (Bullish)

9. Volume Distribution : Slightly higher buying force (Bullish)

Conclusion : 8 Bull 1 Neautral

Entry Price: 0.305

Profit Taking: 0.335, 0.38

Cut Loss : 0.265

Case Study - MRCB

1. Trend Analysis - Sideway trading after in symmetrical triangle in past 6 monyh (Neautral)

2. Form higher high & higher low after breakout from symmetrical trianlge in past 1 month (Bullish)

3. ADX - Storng momentum (Bullish)

4. Bollinger Band : Both upper & lower band are trending up, indication for uptrend (Bullish)

5. Candle Stick: long white body (Bullish)

6. Support : Above 20, 50 & 200 EMA (Bullish)

7. ADX : Uptrend with strong momentum (Bullish)

8. MACD : trending up (Bullish)

9. RSI : Rebounce up from 50%, pending for 70 % breakout (Bullish)

10. Stochastic : Rebounce and break up 80% with bullish crossover (Bullish)

11. Volume Distribution : Strong buying pressure (Bullish)

Conclusion: 10 Bull 1 Neautral

Entry Price: 2.33 on 7/27 or 2.41 thereafter

Profit Taking : 2.52, 2.66

Cut Loss: 2.29

Remarks: Beware of high selling pressure close to market end.

Case Study - KKB

1. Trendline : Sideway since breakdown from symmetrical triangle on 5/16. (Neautral)

2. Resistance & Support : Support line,L1 as indicated as pink color has been the resistance (tested on 5/16, 6/30, 7/8 & 7/11 respectively) since then. Break L1 line with high volume on 7/27 (Bullish)

3. Bollinger Band: Both upper & lower band are widen indicating the begining of price volatilify, since is breakout , thus proability of price moving upward is increasing. (Bullish)

4. Candle Stick: White long body (Bullish)

5. ADX : Uptrend with strong momentum (Bullish)

6. MACD : Bullish crossover with 4R1G above 0 (Bullish)

7. RSI : Rebounce and break up 50% (Bullish)

8. Stochastic: Rebounce and breakout 80% with bullish crossover (Bullish)

9. Volume Distribution : Strong buying pressure whole day long (Bullish)

Conclusion 8 Bull 1 Neautral

Entry Price : 1.99

Profit Taking: 2.02, 2.10, 2.19

Cut Loss : 1.95

Case Study - Affin (Potential Symmetrical Triangle Breakout)

1. Trendline : Consolidatoin in symmetrical triangle -- pending breakout (Neautral)

2. Bolingger Band : Start to open that potentially make price more volatility, sign of breakout (Bullish)

3. Candle Stick : White Body (Bullish)

4. ADX : Uptrend with weak momentum (Bullish)

5. MACD : Bullish crossover above 0 (Bullish)

6. RSI : Rebounce and touching 50% (Bullish)

7. Stochastic : Rebounce and break up 80% (Bullish)

8. Volume Distribution: High selling force by Sharks especially during market end to retailer (Bearish)

Conclusion: 6 Bulll 1 Bear 1 Neautral

Entry Price: 3.51

Profit Taking: 3.61, 3,71, 4.07 (Target Price if symmetrical triangle breakout with volume support)

Cut Loss: 3.40

Remarks: Watch up the volume distribution for recent days, not to be trapped as big sharks are dumping. However, if breakout with high volume and strong buying pressure would have handsome profit (~17.6%). Thus, monitor closely on this counter!

Tuesday 26 July 2011

Case Study - Altera

Aunty Lok,

This is for you.

1. Trendline : Downtrend (Bearish)

2. Support : Below 20, 50, 200 EMA (Bearish)

3. ADX : Downtrend with moderate momentum (Bearish)

4. MACD : Cross below 0 (Bearish)

5. RSI : Cross below 30% (Bearish)

6. Stochastic: Below 50% (Bearish)

Conclusion : 6 Bear 0 Bull

Remarks: Short or medium term, this counter is in downtrend / sideway. It needs to break the pink (L1) line and form higher low or higher high in order to go bullish again. So, sell if you can't wait for it!

Case Study - GENM

1. Trendline : Sideway (Neautral)

2. Candle Stick : Hanging man -- potential bearish reversal, pending confirmation on subsequent day (Bearish)

3. Support: Above 20, 50, 200 EMA (Bullish)

4. ADX : Uptrend with moderate momentum (Bullish)

5. MACD: Bullish crossover (Bullish)

6. RSI : Drop to 50% (Bearish)

7. Stochastic: Above 50%, pending to break 80% (Bullish)

8. Volume Distribution: Selling force is high (Bearish)

Conclusion: 4 Bull 3 Bear 1 Neautral

Entry Price: 3.82

Profit Taking: 3.85, 3.91, 3.98

Cut Loss: 3.70

Remarks : Beware to be trap to be another sideways, high selling pressure. Avoid this counter if possible.

Case Study - Dutalnd

1. Trendline : Sideway (Neautral)

2. Candle Stick : Long white body (Bullish)

3. Bollinger Band : Breakout after squeeze for 2.5 months with high volume support (Bullish)

4. ADX : Uptrend with weak momentum (Bullish)

5. MACD : Bullish crossover (Bullish)

6. RSI : Rebounce from 50% and pending to break 70% (Bullish)

7. Stochastic: Rebounce and break 50%, 80% (Bullish)

8. Volume Distribution: High buying pressure (Bullish)

Conclusion: 7 Bull 1 Neautral

Entry Price: 0.54

Profit Taking : 0.55, 0.58, 0.61

Cut Loss: 0.49

Case Study - KFC

1. Trendline : Sideway (Neautral)

2. ADX : Uptrend with strong momentum (Bullish)

3. MACD : Signal line trending up (Bullish)

4. RSI : Rebounce and pending to break 70% (Bullish)

5. Stochastic : Rebounce from 50% and break 80% with bullish kissing (Bullish)

6. Volume Distribution: Strong buying force (Bullish)

Conclusion: 5 Bull 1 Neautral

Entry Price: 4.00

Profit Taking : 4.09, 4.31, 4.45

Cut Loss : 3.83

Remarks: Beware of getting trap as this setup is a sideway unless breakout with volume support.

Case Study - EPMB

1. Trendline : Downtrend (Bearish)

2. Candle Stick : Long White Body (Bullish)

3. Support : Above L1 line and 20, 50 200 EMA (Bullish)

4. Bollinger Band : Breakout BB Squeeze with volume greater than 30 EMA (Bullishe)

5. ADX : Uptrend with strong momentum (Bullish)

6. MACD : Bullish crossover and pending to cross 0 from bottom (Bullish)

7. RSI : Break 70% (Bullish)

8. Stochastic : Break 80% with bullish crossover (Bullish)

9. Volume Distribution :High buying pressure especially close to market end (Bullish)

Conclusion : 8 Bull 1 Bear

Entry Price; 1.02

Profit Taking: 1.05, 1.11,1.17

Cut Loss : 0.92

Case Study - Daiboci

1. Trendline: Sideway (Neautral)

2. Candle Stick : Long white body (Bullish)

3. Bollinger Band : Breakout with high volume, Upper & Lower band open increase price volatility (Bullish)

4. ADX : Uptrend with strong momentum (Bullish)

5. MACD : 4R1G (Bullish)

6. RSI : Break and stay above 70% (Bullish)

7. Stochastic : Break and stay above 80% (Bullish)

8. Volume Distribution: Strong buying pressure (Bullish)

Conclusion: 7 Bull 1 Neautral

Entry Price: 2.88

Profit Taking : 3.01, 3.15

Cut Loss : 2.78

Subscribe to:

Posts (Atom)